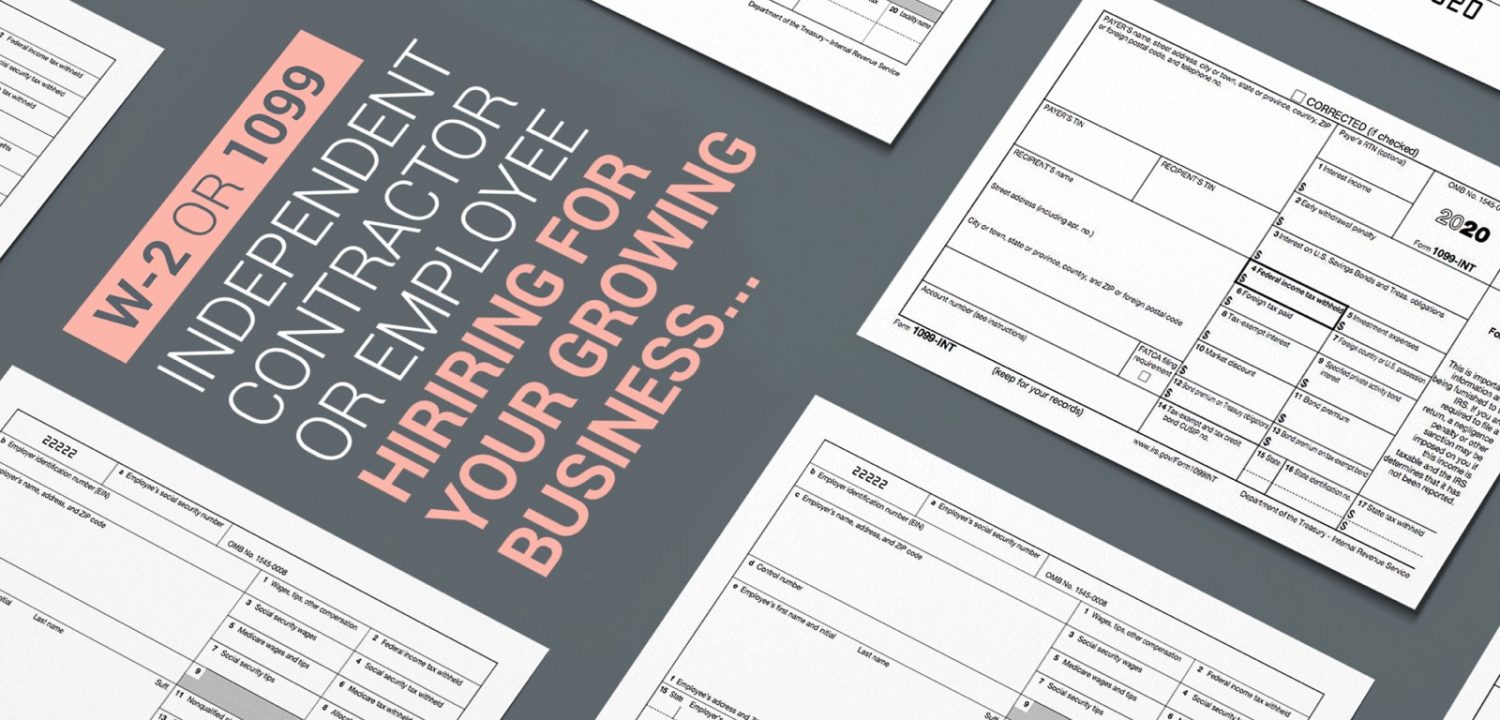

1099MISC Copy B–For the copy you'll ship to the contractor, you may both fill out a bodily copy of Kind 1099MISC or print off an digital model of Copy B from the IRS web site You should definitely ship the finished kind to the contractor by January 311099 and W2s are the different tax forms used to deduct payroll taxes on different types of employees 1099 employees are selfemployed independent contractors They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return A W2 employee receives a regular wage and employee benefits1099 Contractors Resources 5 likes Informational only page for resources related to helpful information for all 1099 contractors!

Www Nmerb Org Wp Content Uploads 06 Nmerb Independent Contractors Application Pdf

1099 contractor jobs

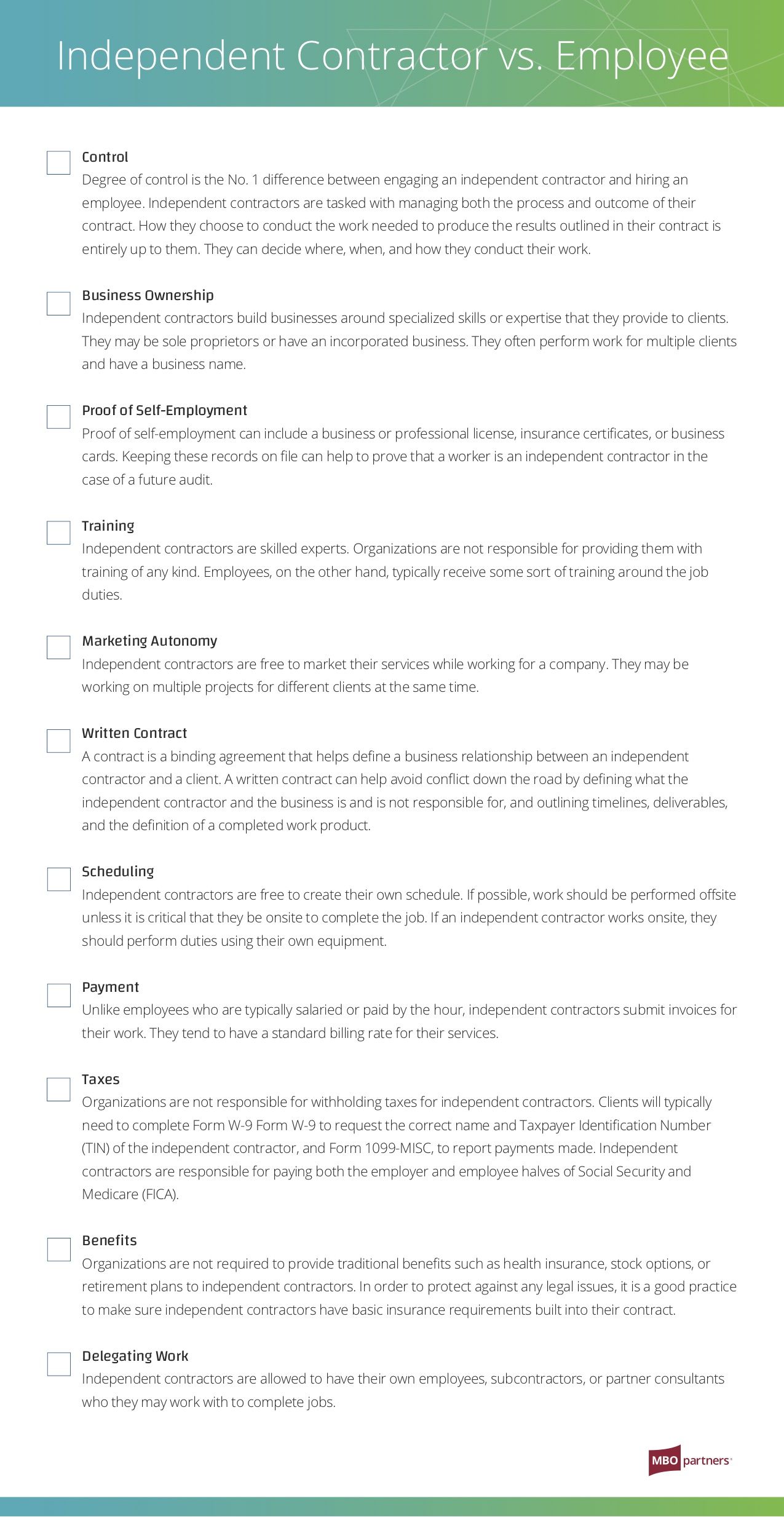

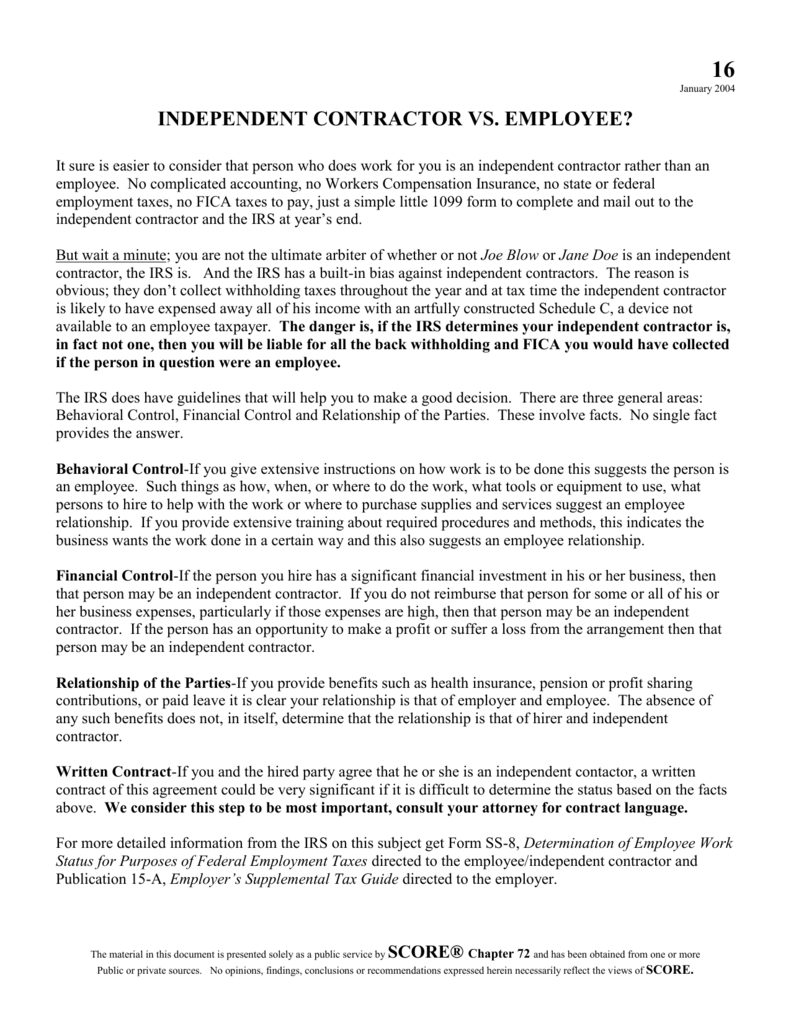

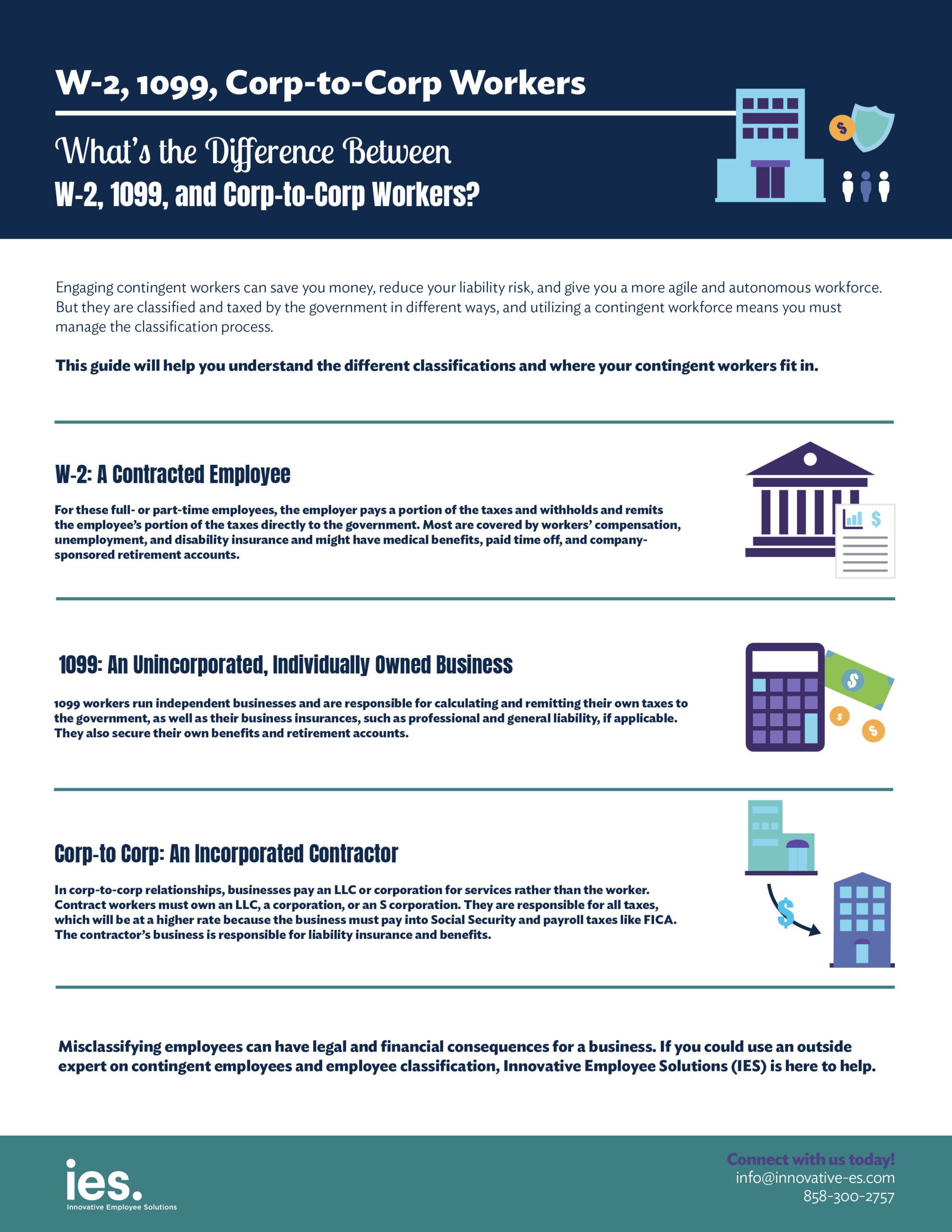

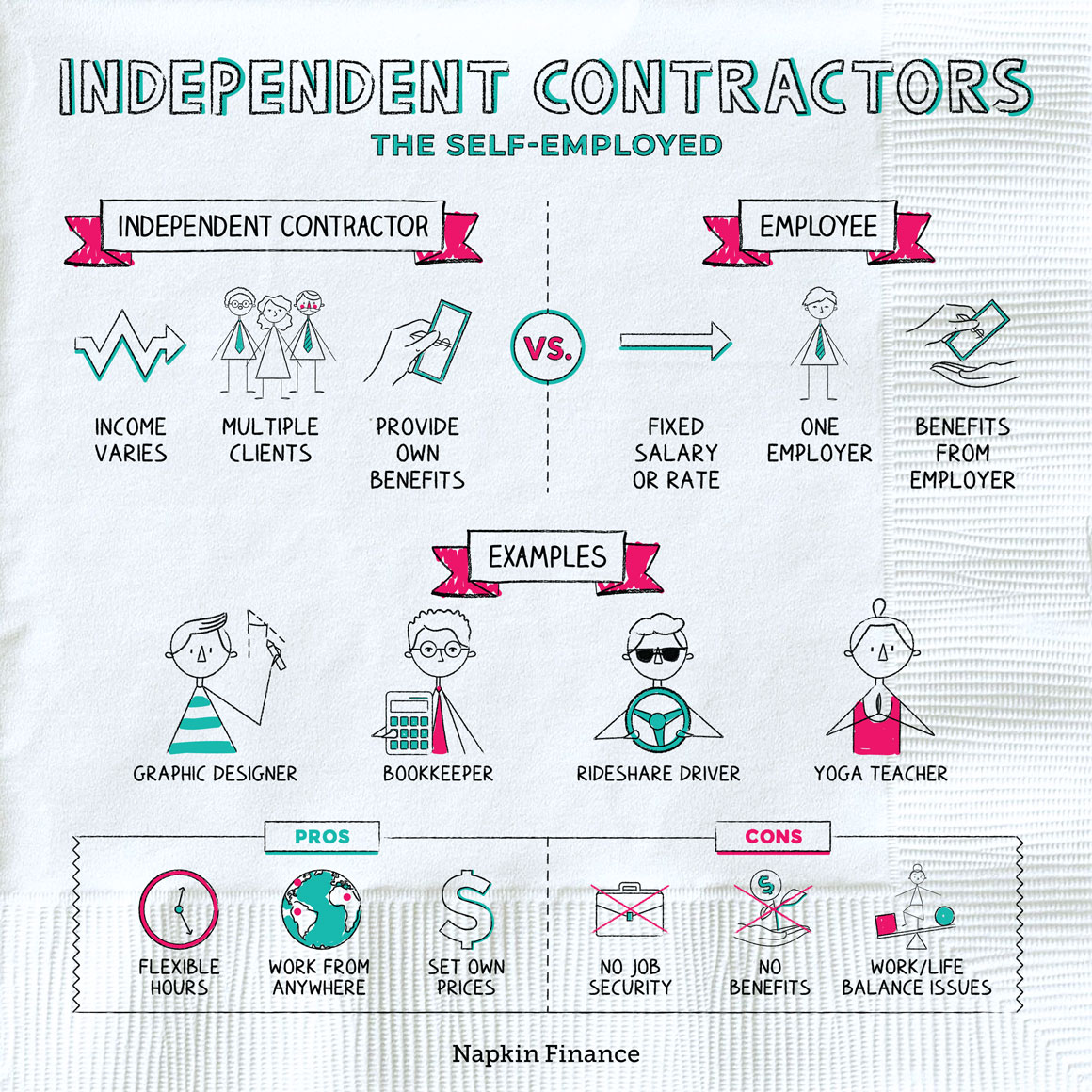

1099 contractor jobs-A 1099 contractor, also known as an independent contractor, is a classification assigned to certain US workers The "1099" reference identifies the tax form that businesses must file with the Internal Revenue Service , and it relieves the employer from the responsibility of withholding taxes from the individual's paychecks Although independent contractors provide a service to an organization, A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the company

W 2 Employees Vs 1099 Contractors Due

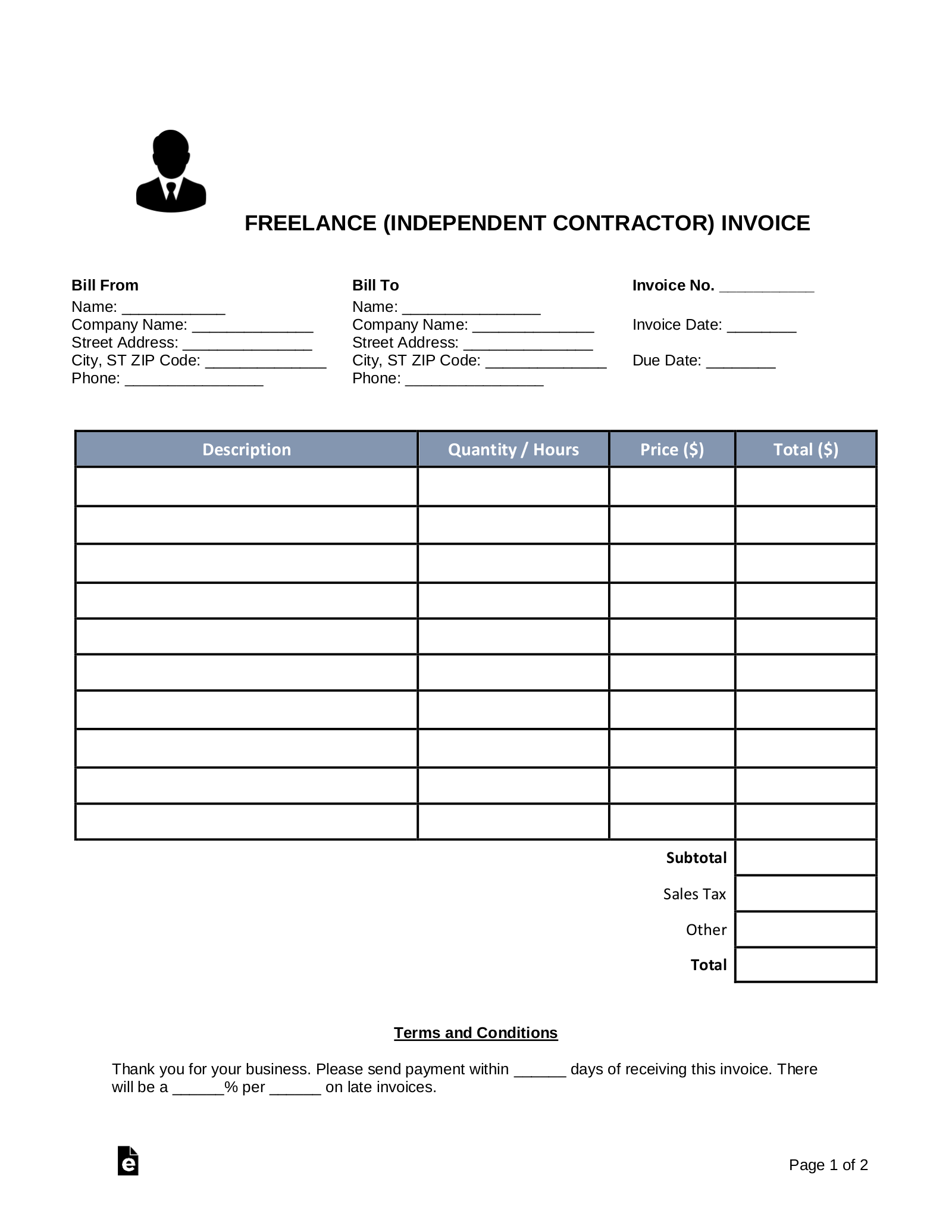

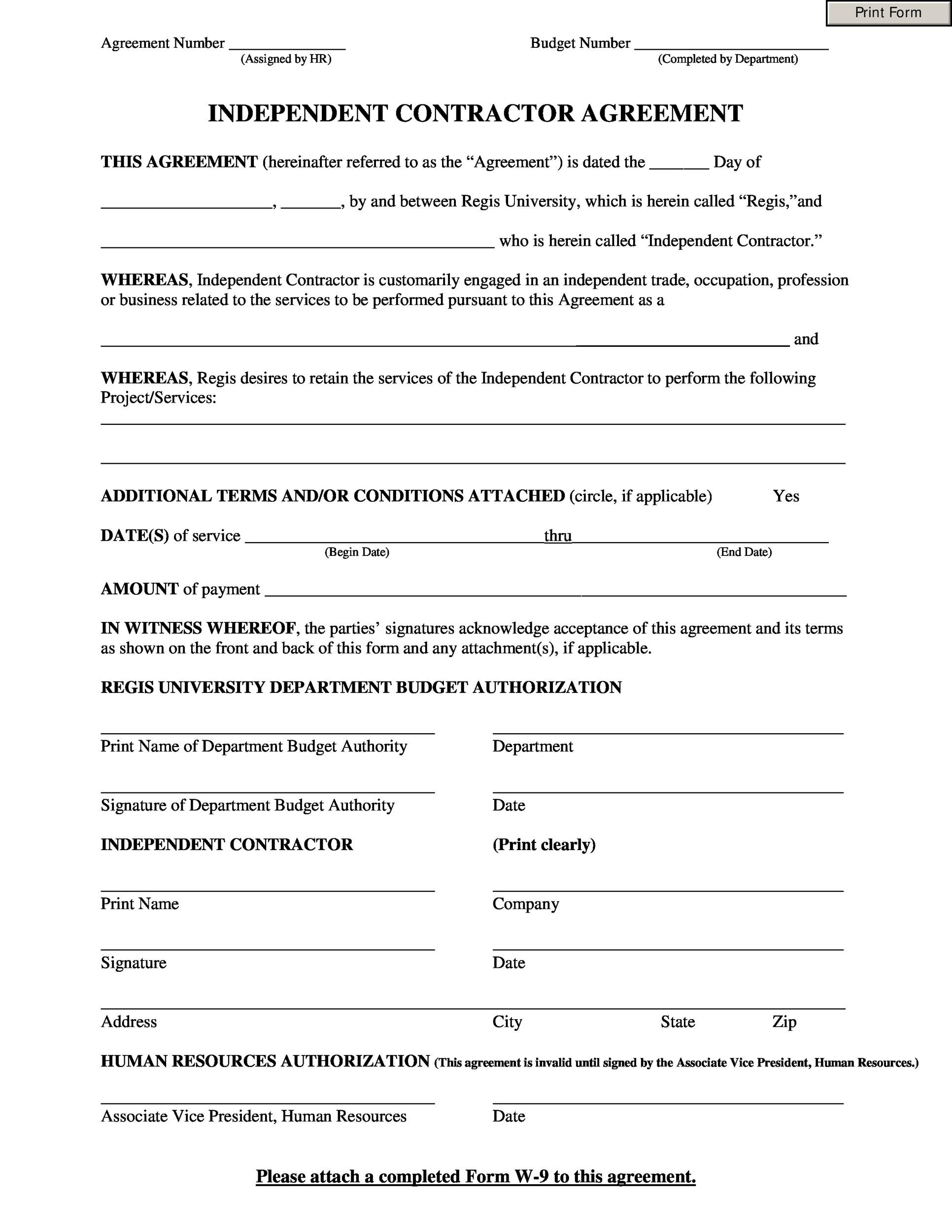

CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the other There are actually different 1099 forms, but the most commonly used is the 1099NEC for reporting contractor payments Previously the 1099MISC was for reporting contractor payments, but the IRS released the new 1099NEC in However, the 1099MISC still has uses, as it is used for reporting payments to an individual or LLC in excess of"1099 Reports" shows the 1099 Summary Report just for this contractor This is a preview of the dollar amounts that will appear when you create the Form 1099 for this contractor To edit a contractor Payroll > 1099 Contractors > Contractor List Click the Contractor name You are now on the "Contractor Info" page Click Edit You can

Any business hiring a 1099 independent contractor must verify the worker or company is legitimately operating under California's new laws If your 1099 workers perform similar tasks to your employees, or if you are uncertain your 1099 workers have current business entity filings, licensing, and other elements as outlined in AB5, get the peace of mind of a got1099It's not simply a matter of knowing to give your worker a 1099 vs W2 tax forms How your workers are classified affects their legal protections (like minimum wage and OT rights), taxation and benefitsAs an independent contractor, you may receive a 1099K or form 1099MISC, you'll want to make sure you have those on hand You may also have W2 income, interest or dividend statements and you'll need all of that information ready for you in one place once it's time to prepare your taxes

Form 1099 is a government tax form that businesses use to report any money they've paid to individual contractors The only time you'll receive a 1099MISC form from a business is if that business paid you $600 or more in a tax year The pay you receive from the work you find through the VitaWerks doesn't have taxes deducted, so it will As a 1099 contractor, you receive more tax deductions like business mileage, meal deductions, home office expenses, and work phone and internet costs, as well as other business expenses that can lower your taxable income Therefore, contractors might end up paying fewer taxes than a traditional employee would How to make more money from 1099 deduction expenses as an independent contractor There are a few things that can be done to write off taxes and make more money 1 Home office An independent contractor or a self employed individual has the liberty to work from their choice of space, which can also be their home

3

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

A 1099 contractor is a separate business entity on its own You are not considered an employee under this contract If you are hired on as a 1099 contractor, you will have a lot of flexibility First, you get to set your own hours, ie you get to pick when you want to work and when you don't This is ideal if you are still working a full A 1099 worker can work with more than one client at one time and gain a higher income than a W2 worker Your professional skills or expertise play a major role in deciding whether you can work as a 1099 independent contractor or a W2 employee Majority of hired 1099 workers prefer working from home or coworking spaces than a regular office spaceA 1099 form is a tax document filed by an organization or individual that paid you during the tax year "Employees get W2s This is the equivalent of a W2 for a person that's not an employee,"

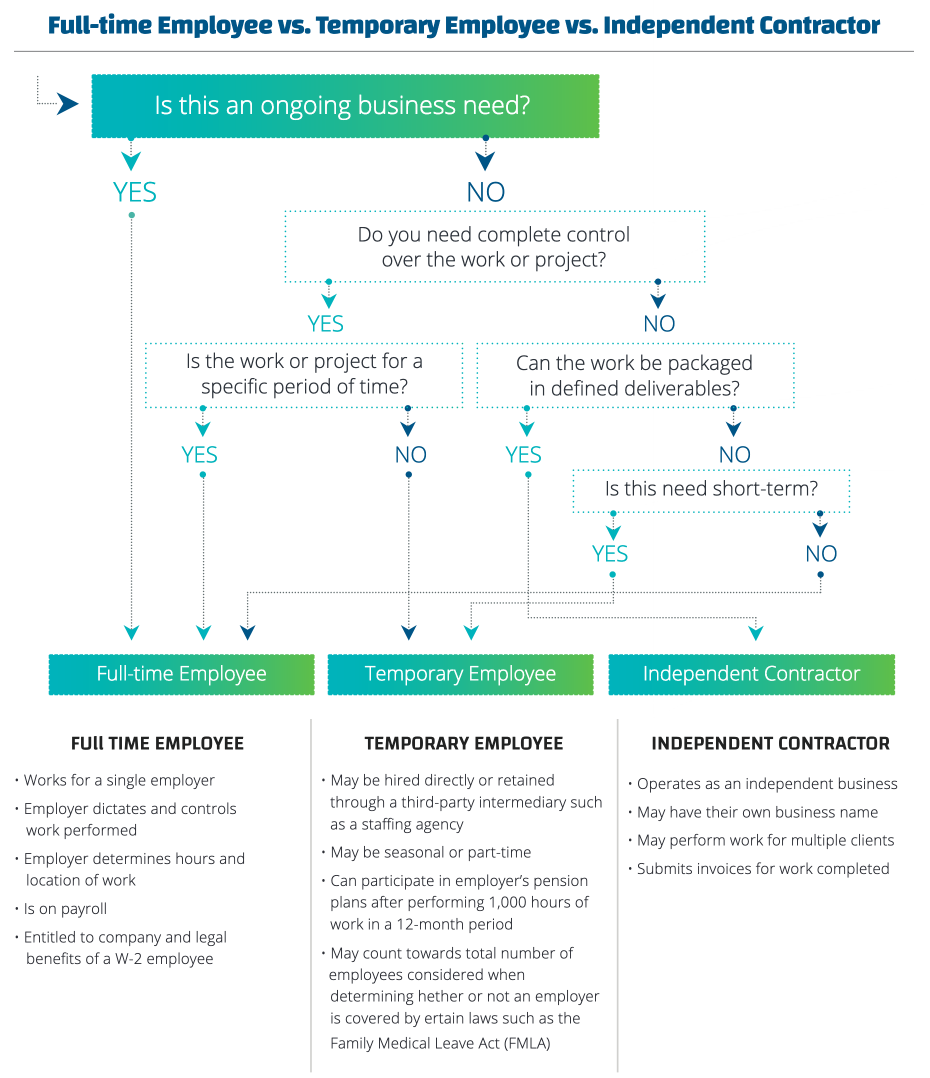

Employment Types Determine If You Need An Independent Contractor Temp Or Employee Mbo Partners

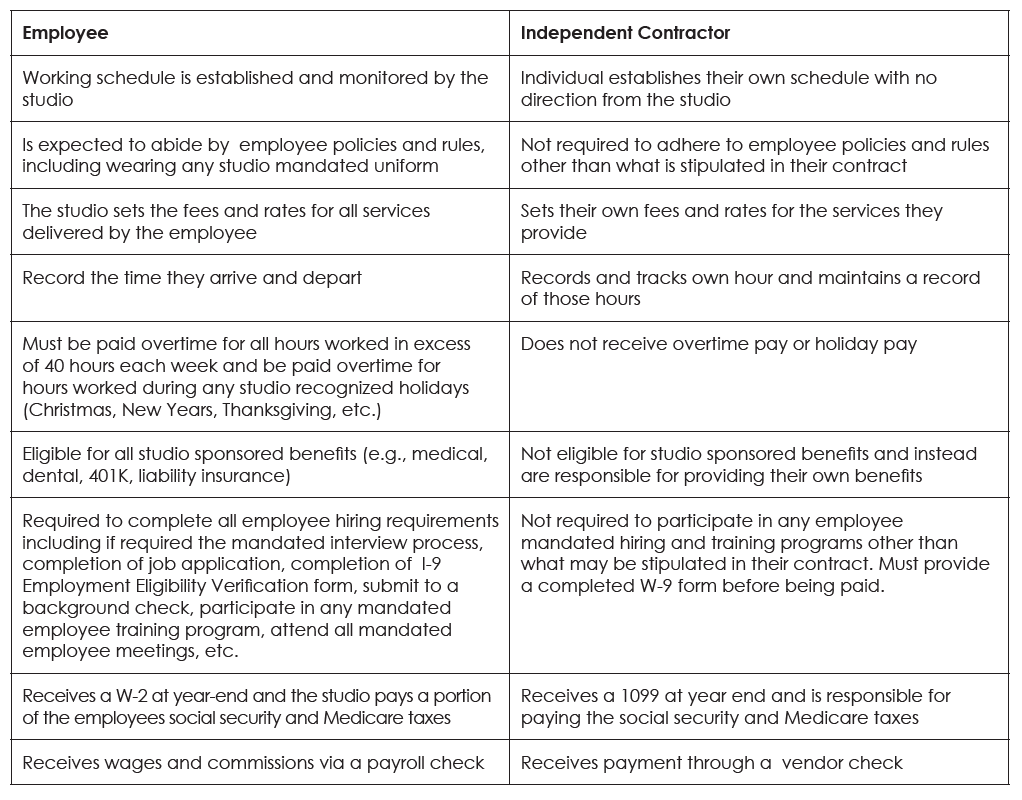

Employee Or Independent Contractor Which One Is Best For My Business The Association Of Fitness Studios

A 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to taxes, payments, and the like1099 independent contractors are selfemployed freelancers and usually receive payments according to the terms of a contract They report income on their tax return with the IRS by getting a 1099 misc tax form Let's dive deeper into what distinguishes 1099 contractors and W2 employees What is a W2 Employee?1099 Contractor Payroll Comparing legacy payroll providers to Gig Wage is like comparing the Post Office to Amazon There is no comparison Automated Payouts Sending payments takes seconds, whether you're paying ten contractors or ten thousand Payment Tracking

Solved How To Prepare 1099 Miscs For Independent Contractors In Quickbooks Online Plus

1099 Employees Everything Employers Should Know Vensurehr Blog

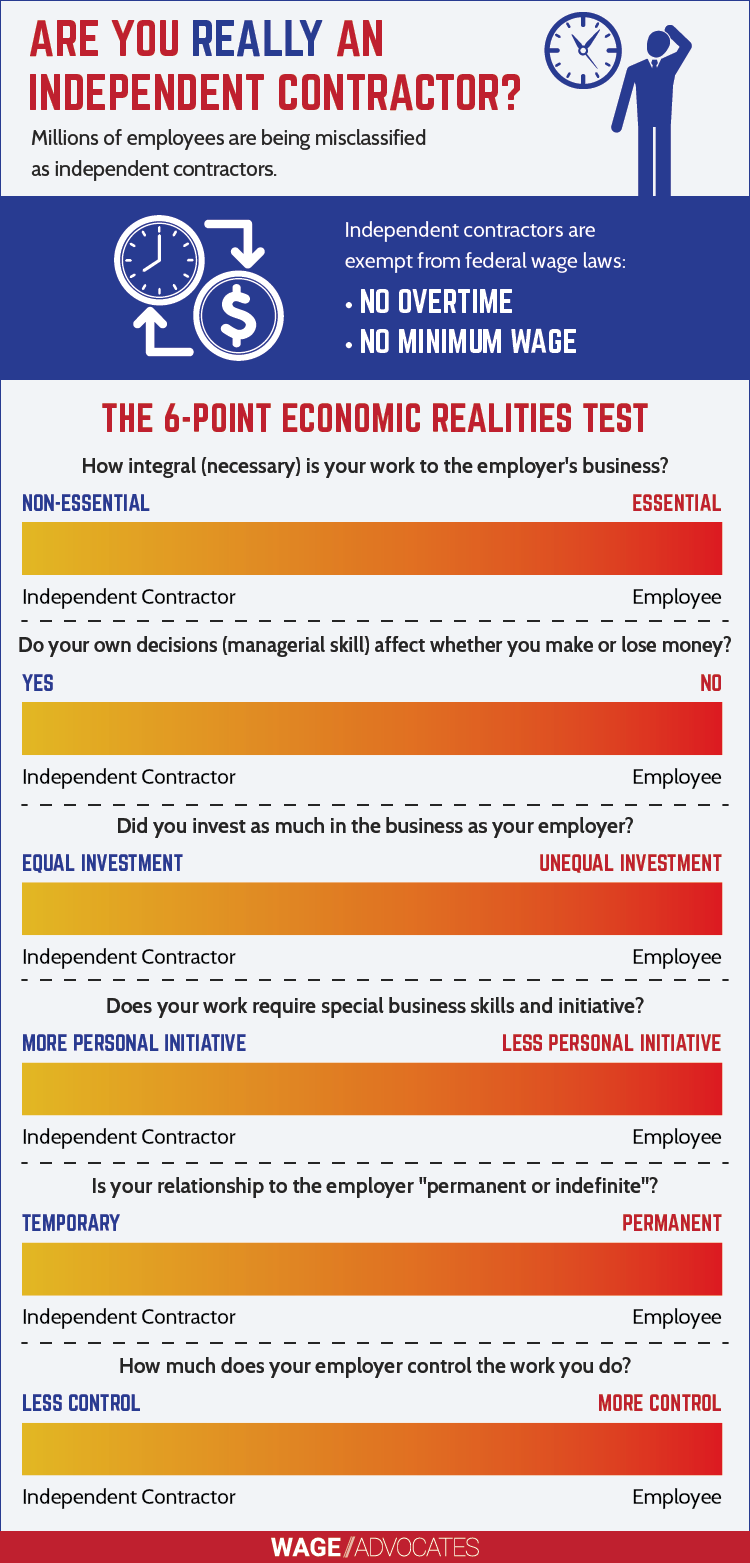

Overtime for 1099 Independent Contractors The matter of classification of employees as independent workers and not employees is a move by employers to seek tax benefits at the expense of employees By classifying employees as independent contractors, employees receive 1099 tax forms as opposed to W2's, tax forms used by employees The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous) Table of Contents Companies and organizations rely on either employees or 1099 contractors to perform specific tasks It is worth understanding the overtime rules that apply to the two types of service providers A 1099 worker, also known as an independent contractor, provides an entity's services as a nonemployeeIndependent contractors use a 1099 tax form rather than a W2

Top 25 1099 Deductions For Independent Contractors

Www Albanylaw Edu Centers Government Law Center The Rural Law Initiative Resources Employment Law Documents Employees Independence Contractors Pdf

As a 1099 independent contractor, all you need to do is make sure you have the proper licenses and permits for your business and simply start conducting business While there is paperwork involved with setting up the LLC, the LLC structure provides an independent contractor with personal liability protection Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether these1099 independent contractors do not enjoy the same protections as employees since they are in charge of the performance of their work They provide their tools and are a separate entity by themselves As such, they cannot legally sue employers for wrongful termination However,

Independent Contractor Vs Employee Explained California Law 21

1099 Misc Form Fillable Printable Download Free Instructions

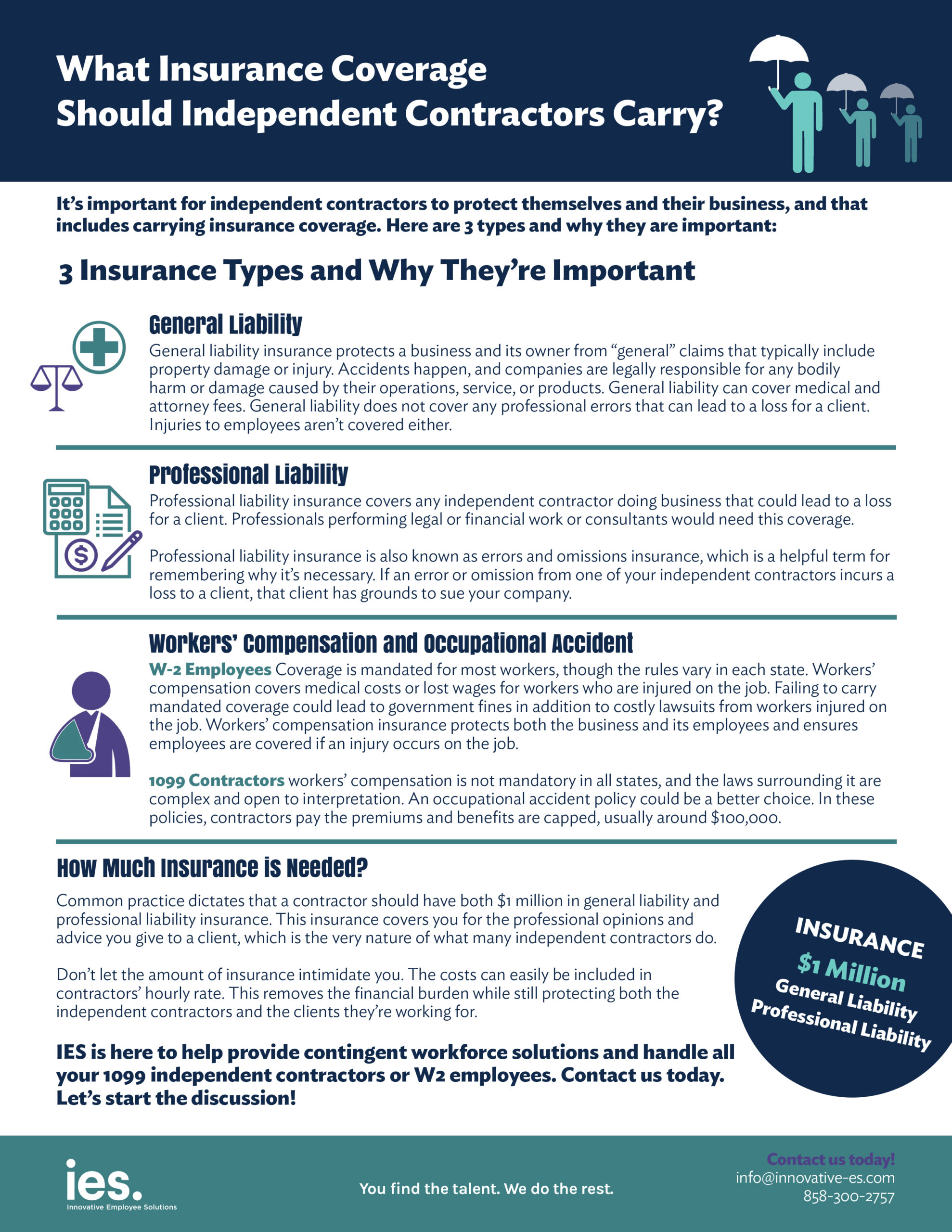

A 1099MISC is for Miscellaneous Income and it is the type of 1099 that is used when others don't apply Freelance and independent contractors receive these types of forms after getting at least $600 in paymentWorkers Compensation Insurance for 1099 Contractors Workers' compensation insurance is a musthave for employers;Contractors can view their payment statement, Add or edit bank account information, update or eSign documents required (Form W9, Direct Deposit Authorization Form) and view the 1099 form generated for them See these features in action and simply make payments to your contractors Give a try to our contractor payment solution!

1099 Misc Form Fillable Printable Download Free Instructions

How To Pay Tax As An Independent Contractor Or Freelancer

1099 vs W2 Worker classification is how you determine whether a worker is an employee or an independent contractor What's at stake?In fact, it's the law in every state While it may be clear that you have to carry a policy that covers all employees it can get confusing if you also use independent contractors, also known as 1099 contractors, in your business A 1099 contractor is the same thing as an independent contractor The number "1099″ refers to the tax forms that contractors fill out detailing their earnings from the year The terms "independent contractor" and "1099 contractor" are often used interchangeably

Independent Contractor Contract Template The Contract Shop

Free Independent Contractor Agreement Templates Pdf Word Eforms

Business license changes, expired EINs, pending audits or investigations, or lapses in professional requirements all trigger alerts during the 3 month period The Quarterly Alerts can only be activated for 1099 contractors whose assessments were completed under the single assessment review and reporting This product cannot be purchased alone 1099 Contractors and Freelancers Most sharing economy workers are 1099 contractors for tax purposes However, you can avoid 1099 contractor status if you formed a corporation for your business The IRS taxes 1099 contractors as selfemployed If you made more than $400, you need to pay selfemployment taxEach 1099 contractor is responsible for covering all benefits, taxes, and Social Security withholding entirely out of their pockets Which type of worker to bring onto your team depends on the nature of your business, the nature of the work to be performed, and other factors Many companies ultimately using a combination of employees and contractors

My Employer Says I M An Independent Contractor Does L I Cover Me

Employee Vs Independent Contractor Apollomd

Form 1099 is a government tax form that businesses use to report any money they've paid to individual contractors The only time you'll receive a 1099MISC form from a business is if that business paid you $600 or more in a tax year The pay you receive from the work you find through the Clipboard Health doesn't have taxes deducted, so itA 1099 contractor is a legal and taxrelated term used in the United States to refer to the type of worker who contracts his services out to a business or businesses These contractors exist in multiple fields — from hospital planners, to marketing consultants, to building contractors, to freelance writers The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary parties

Change Is A Good Thing Hype S Talent Is All W2 Variable Hour Employees

Therapists Hiring Independent Contractor Vs Employee

The tax type 1099MISC is utilized by companies to report funds made to impartial contractors throughout the previous yr A person or enterprise that pays an impartial contractor $600 or extra in a calendar yr is liable for sending the contractor a accomplished 1099MISC (Copy B) by January 31 of the next calendar yr These are referred to as "1099 contractors" since Form 1099 is the tax form that the IRS requires companies to file when they pay any contractor over $600 per year The 1099 filing typically only applies to USbased contractors, but there are exceptions to this rule, such as when a foreign contractor performs any services on US soil Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)

Free Independent Contractor Agreement Pdf Word

3

W 2 Employees Vs 1099 Contractors Due

18 Independent Contractor Ideas Independent Contractor Contractors Small Business Tips

Blog Employee Or Independent Contractor Know The Difference Dynamic Office Accounting Solutions

Www Nmerb Org Wp Content Uploads 06 Nmerb Independent Contractors Application Pdf

Http Www Aesi Com Wp Content Uploads 16 01 Risks With 1099s Pdf

Independent Contractor 1099 Invoice Templates Pdf Word Excel

1099 Vs W2 How 4 Different Agencies View Independent Contractor Relationships Infographic Employers Resource

Tour Guides A Tour Operators Handbook Ppt Download

How To Legally Hire Independent Contractors Updated In 18

Who Should You Hire Independent Contractor Vs Employee Top Echelon

Why You Need To Understand The Difference Between Independent Contractor Self Employed And Employee Nurse Practitioners In Business

What Is An Independent Contractor Non Employee Workers

Independent Contractor Vs Employee What S The Difference Bench Accounting

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

12 Myths About Independent Contractors Debunked By Dol Infographic Employers Resource

Employee Vs Independent Contractor What S The Difference

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice

1099 Misc Instructions And How To File Square

Employee Versus Independent Contractor The Cpa Journal

50 Free Independent Contractor Agreement Forms Templates

Overtime Pay Guide For The Independent Contractor

Q Tbn And9gcqbpdyqey1pj Ilzibnx5qeyndhc7isd14rfsuvsig Usqp Cau

Independent Contractor Agreement Template Contract The Legal Paige

Use Our Compliance Checklist To Minimize Contractor Risk Mbo Partners

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Free Freelance Independent Contractor Invoice Template Word Pdf Eforms

W 9 Vs 1099 Understanding The Difference

Employee Classification How Do I Classify My Brokers As Independent Contractors Or Employees Chicago Association Of Realtors

What Is A 1099 Misc Stride Blog

3

Independent Contractor Vs Employee What Can These Workers Offer Your Business Paychex

Independent Contractor Or Employee

Employee Versus Independent Contractor The Cpa Journal

Independent Contractor Agreement Business Taxuni

What S The Difference Between W 2 1099 And Corp To Corp Workers

W2 Employee Versus 1099 Independent Contractor Compliance Checklist Liquid

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Abc Test Passed Into Law What Happens Now Solopoint Solutions Inc

Do Your Employees Require A 1099 Or W 2 Employee Or Independent Contractor

1099 Misc Form Fillable Printable Download Free Instructions

1099 Vs W2 Difference Between Independent Contractors Employees

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Free Michigan Independent Contractor Agreement Word Pdf Eforms

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Instant Form 1099 Generator Create 1099 Easily Form Pros

Independent Contractor Vs Employee What S The Difference

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

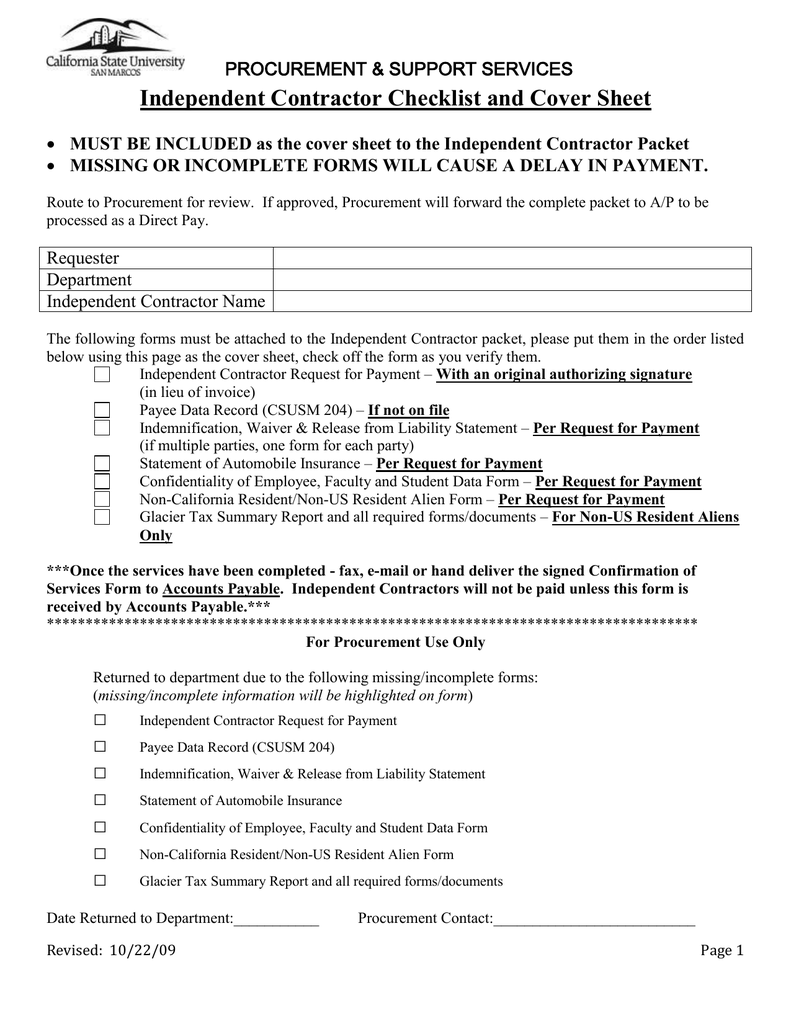

Independent Contractor Packet

Wondering How To Retain Employees Without Going Bankrupt During The Covid 19 Crisis Independent Contractor Reclassification Is Not The Answer Wage And Hour Defense Blog

Salaried Employees Vs Independent Sales Reps Which Is Best For Your Global Enterprise Express Global Employment

Http Www Halunenlaw Com Wp Content Uploads 14 05 Characteristics Of Employee Pdf

How To Become An Independent Contractor And Not An Employee Youtube

Businesses Concerned About Covid 19 Unemployment Benefit Rights For Independent Contractors Independent Contractor Compliance

Ab 5 And The New Abcs Of Worker Classification Infographic

Everything You Need To Know About Paying Contractors Wave Blog

Filing Taxes 1099 Forms Every Independent Contractor Should Know About Moves Financial

Types Of 1099 Forms Shefalitayal

Independent Contractor Billing Template Awesome Independent Contractor Invoice Invoice Template Ideas Invoice Template Invoice Example Invoice Template Word

5 Reasons I Switched From A Salaried Employee To A 1099 Independent Contractor

Independent Contractor Expenses Spreadsheet Business Tax Deductions Small Business Tax Deductions Business Tax

What Is An Independent Contractor Napkin Finance Has Your Answer

50 Free Independent Contractor Agreement Forms Templates

What Is A 1099 Vs W 2 Employee Napkin Finance

Make More Money Become An Independent Contractor

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Independent Contractor

Understanding The Differences Between Hiring An Employee Or An Independent Contractor Dcc Accounting

How To Become A 1099 Independent Contractor As A Physician Assistant Youtube

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Infographic Contractor Vs Employee What Is The Difference Milikowsky Tax Law

Employee Misclassification What Happens When You Mistake An Employee For An Independent Contractor Dominion Systems Dominion Blog

Independent Contractor Agreement Pdf Pdf Independent Contractor Registered Mail

Independent Contractor Contract Template The Contract Shop

Www Nelp Org Wp Content Uploads Policy Brief Independent Contractor Vs Employee Pdf

What Insurance Coverage Should Independent Contractors Carry

Do 1099 Employees Qualify For Workers Compensation Coverage In Missouri

1099 Contractor New Hire Forms Packet Arecruitmentstore Com

Free Florida Independent Contractor Agreement Pdf Word

17 Tests To Decide Employee Or Independent Contractor Dasco Insurance Agency Northbrook Il

Contractor Profit And Loss Template Simple Business Guru

Flsa Self Audit Compliance Can Help Small Business Employee Or Independent Contractor

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

How Do I Know If I Should Hire An Employee Or An Independent Contractor Ledger Harmony Bookkeeping For Small Businesses

It S Irs 1099 Time Beware New Gig Form 1099 Nec

No comments:

Post a Comment